After decades of fast growth brought about by the demographic dividend, the rapid expansion mode of China's insurance industry came to an end in recent years and began to transform from 'high-speed' to 'high-quality'. Recently, Ultipa participated in the PNP Insuretech Acceleration Camp and discussed with investment institutions and industry experts how technology can empower and reshape insurance companies, and how the insurance industry can embrace technology.

The insurance industry has long been lagging in terms of the level of informatization and digitization compared with other traditional financial fields such as Banks and Securities. However, the rapidly developing new technologies, artificial intelligence, blockchain, cloud computing, big data, etc., have made this laggard a new 'outlet' in the industry.

Guaranteed service | Improved users' sense of achievement

During its rapid development in the past decades, China's insurance industry has exposed many problems. Poor user experiences caused by unclear claim definition, complicated claim process, and incompetent agents, etc., directly spoiled the image of the industry, thus having a far-reaching impact on the further development of the industry. In this context, InsureTech will become a cure for those chronic diseases of the insurance industry.

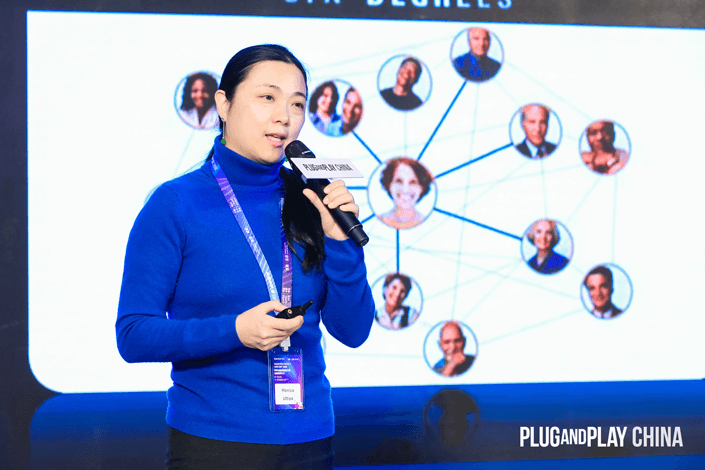

Ultipa COO Monica said the development and application of fintech have created a breakthrough opportunity for the insurance industry to turn the tide.

Photo: Ms. Monica Liu, co-founder of Ultipa

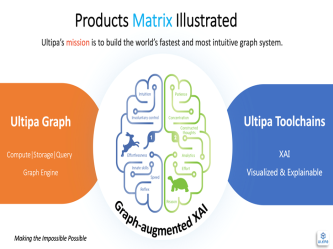

Ultipa is a high-tech enterprise that develops real-time graph databases and highly-visualized knowledge graph. As the core driving technology for the new round of upgrading of big data processing technology, "graph computing and graph database" is currently the frontier field of industry and academia.

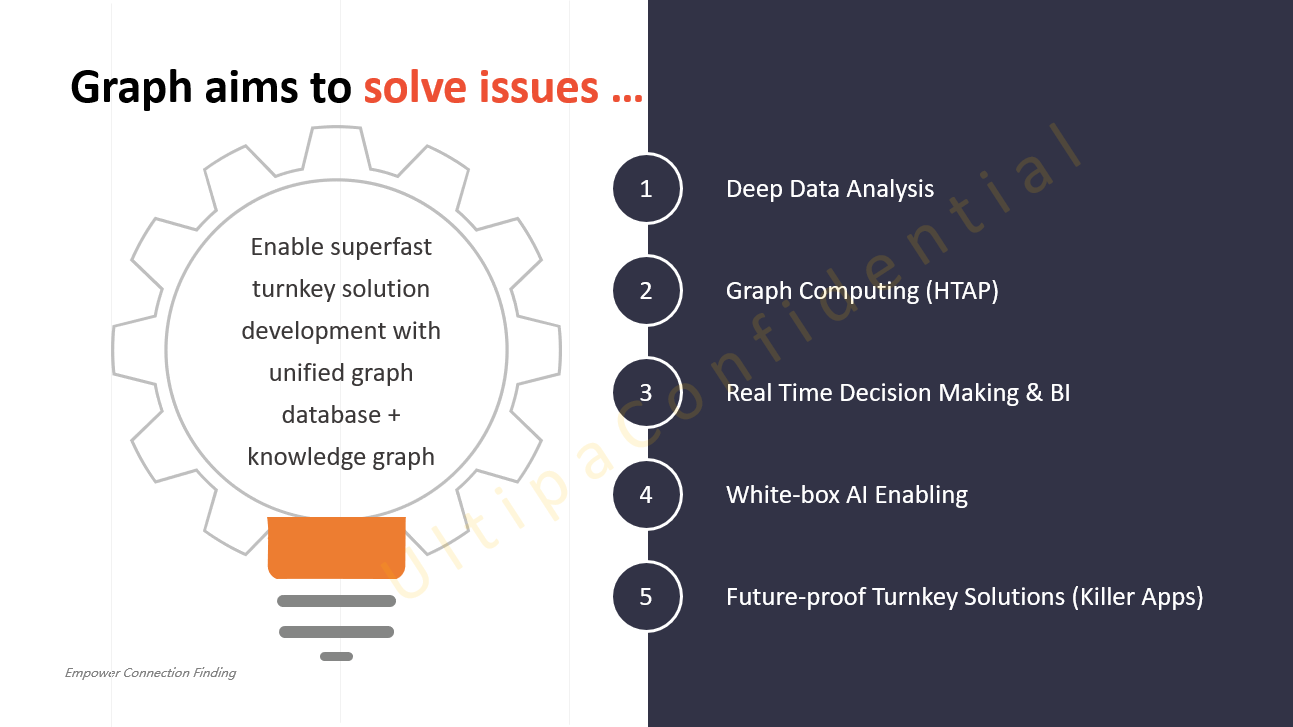

Against the pain points faced by insurance enterprises, such as product design far from satisfying user needs, product terms difficult to understand, users' sense of achievement too low, etc., Ultipa leverages its patent-pending real-time knowledge graph computing with features of "computing power + algorithm + visualization + explainable AI" to help insurance companies to complete a disruptive upgrade from the existing architecture, hence improve their businesses such as intelligent customer service, intelligent agent, smart claim, insurance underwriting, mobile claims, etc...

◈ Ultra-high-speed system. At all times, the business handling speed and customer satisfaction is the core measurement of the service quality of insurance companies. Ultipa Graph's hyper-concurrency and ultra-fast memory computing engine architecture can complete a vast amount of data analysis, decision evaluation, and personalized solutions in real-time (comparably hundreds of times faster than previous big-data tech infrastructures).

◈ High visualization. Can machines think and act/react as humans do? Can they solve personalized needs and deliver a 100% user experience? As graph embedding and graph learning being the new cutting-edge direction in the field of artificial intelligence, Ultipa naturally supports seamless unison of high-performance graph computing and highly visualized knowledge graph, and empowers one-stop-shop fashion of data ETL, real-time analytics, and interactive insights, just like the left-n-right human brains working jointly. Data interchange among insurance businesses such as underwriting factors, risk prevention, and control, product recommendation, precise calculation of compensation amount, etc., no longer needs to rely on multiple isolated systems or cumbersome data ETL.

◈ Ease of use. Building customized system solutions for specific application scenarios and fields is technically and managerially a complex process. Ultipa relentlessly pursues speed and simplicity of every step from system architecture design, tool-chain to scenario-specific explainable implementation, enabling insurance companies to quickly achieve system optimization, customization, deployment, launch, and application.

Higher efficiency with lower cost | Technology-created value

Improve operational efficiency. As a personnel-intensive industry, the insurance industry is estimated to have a labor cost of about 30% of its overall cost, which highly restricts the enterprise profitability in terms of human resources problems such as compensation and benefits, training cost, and staff turnover. As reported, the labor cost of China's insurance industry is around 500 billion yuan in 2019.

"The insurance industry naturally has big data genes, and data is the 'core asset' of the insurance industry," Monica said insurance is an industry that deals with risk-related businesses that depend on a large amount of data. Whereas the traditional data processing technique is a relatively backward process, of which the timeliness, accuracy, data discriminability and so on all disappoint, in the massive and complex data-driven IT and operational environment nowadays, the expectations of the business operators and customers; financial institutions waste a lot of money every year to cope with the inefficiencies.

Learned, Ultipa graph database can perform real-time in-depth data mining, therefore completely alter or solve manpower landscape of insurance institutions. In addition, it can fully explore and analyze customers' insurance needs, consumption preferences, and on-line behaviors, provide a smart data basis for the development of customized and intelligent insurance products, and create necessary conditions for accurate pricing and scenario-based marketing.

Reduce the cost of risk control. Insurance fraud exists since the birth of the insurance industry. It occurs in various types of insurance such as car insurance, personal accident insurance, corporate insurance, etc. Aiming at the business pain points of "high insurance fraud rate and fraud loss", Ultipa can promote the traditional risk control module at the back end into real-time smart anti-fraud risk control, and greatly improve the efficiency of loss determination and claim settlement, and ensure a high-quality development of insurance industry.

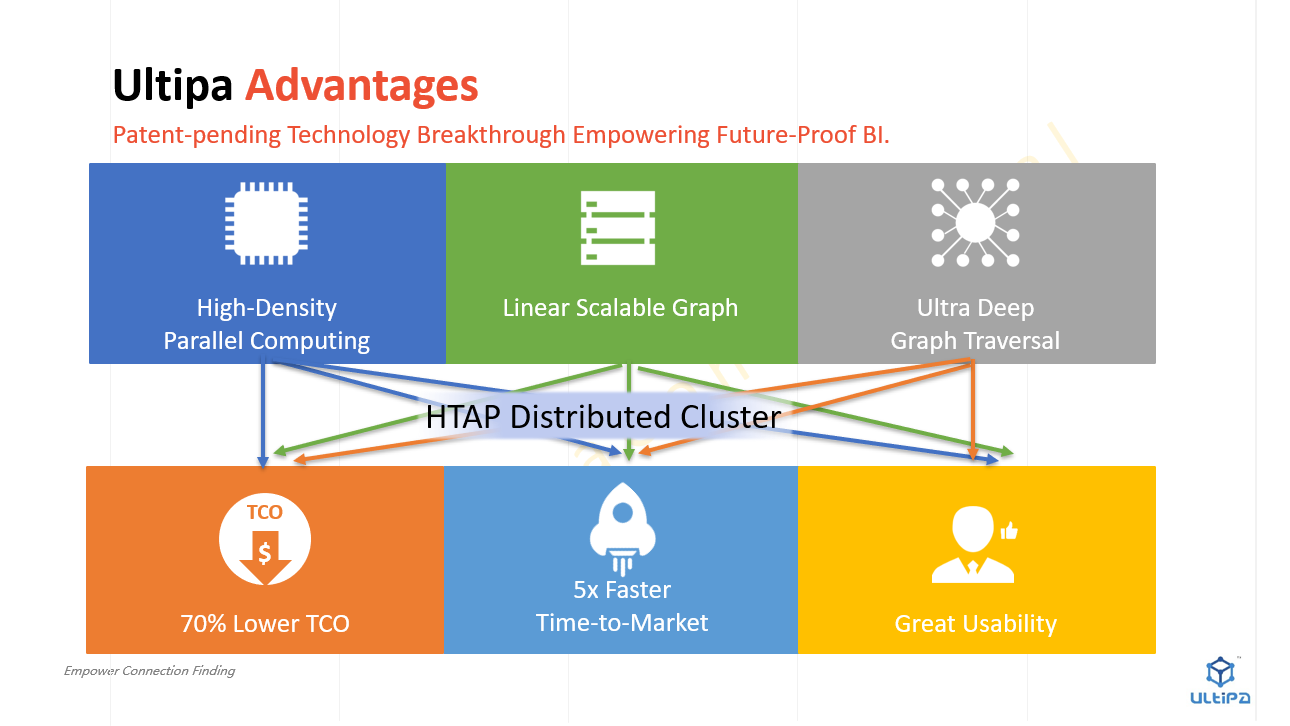

"We've been emphasizing 'real-time' a lot, quite literally, 'fast'! Being able to import, export and process graph data with 'lightning' speed, enterprises can identify the underlying risks in every insurance transaction in the first place." Monica stressed in her speech. It is understood that one of the high performances of Ultipa products manifests as an "acme of speed". Ultipa graph database runs 10,000 times faster than the traditional relational databases and more than 100 times faster than other big data frameworks. "Ultipa traverses multiple dimensions of data points and their associated networks in a deep map, and quickly completes, in a highly concurrent manner, a range of precise detections from system defense, fraud risk assessment to real-time decision making in 20 milliseconds -- faster than the blink of an eye."

◈ Interpretability. In the field of deep learning and neural networks, AI operates in the black-box fashion, the downside of which is that once some symptoms appear, tracing the cause may be a needle-in-a-haystack project, basically un-explainable. Ultipa graph system is an AI white box, namely, it lets people "know what and know-how". All entities and relations of Ultipa graph system have their own weights and attributes, and each operation is intuitive, definitive, transparent, and interpretable, essentially white-box.

◈ Convenience. To reduce the learning cost of enterprise staff and improve business efficiency, Ultipa develops its UQL (Ultipa query language) which takes just 20 minutes for an average person to get started using Ultipa graph system. Before this, learning database query language is undoubtedly a challenge for business staff. Such as Cypher, the language in common use today, which still takes a junior developer two to four weeks from learning to using it, and Gremlin, which requires even higher cognitive loading.

It is worth mentioning that Ultipa graph data system can help enterprises save more than 70% of their TCO (total cost of ownership), and reduce the solution implementation cycle by 80%.

Value chain reshaping | Business model innovation

China's insurance industry has long been relying on 'crowd tactics'. The kind of business models established by 'person-to-person' contact was much restricted or impossible during the COVID-19 pandemic. Insurance companies are challenged on how to acquire (new) customers accurately and provide high-quality post-sales service.

According to data released by the State Council Information Office, the original premium income of China's insurance industry in the first quarter of 2020 was 1.67 trillion yuan, with a year-on-year growth of only 2.3%. Affected by the downward pressure of the global economy this year, this YoY growth rate fell 13.6% compared with last year, among which the growth rate of life insurance fell 15.22%. The unprecedented situation of this year has led to a short-term growth pressure of the insurance business and constraints on offline operations, which pushes the industry to rethink the strategies spanning across their traditional business model, talent and technology reserve, customer development and maintenance, and other aspects.

As a result, traditional insurance companies actively invest in the construction of InsureTech, and large insurance companies represented by Ping An, PICC, and CPIC have raised 'insurance science and technology' to a strategic level. It is reported that China's insurance institutions have invested 31.9 billion yuan in science and technology in 2019, which is expected to grow to 53.4 billion yuan in 2022.

As the provider of a real-time graph database platform, Ultipa can help insurance companies dig out valuable information from huge amounts of data with speed and simplicity, therefore changing their traditional way of pricing, marketing, and underwriting. This empowers a new business model of 'insurance + technology + services' that fits the high-quality need of the development of the insurance industry in this new era, which also reshapes the value chain of the insurance business.

Ultipa graph database system runs 10,000 times faster than the traditional relational database and 100 times faster than other big data frameworks

---副本_2.png)