Company Background

Ultipa is Founded by serial entrepreneurs and deep-tech inventors from Silicon Valley & Beijing. Our mission is to tackle business challenges with augmented intelligence - Graph Database & Knowledge Graph with Ultipa Graph Query Language.

Our products are designed for BFSI core and high-value scenarios: OLTP + OLAP → HTAP.

Company Vision

Ultipa team is dedicated to building the world's fastest and most intuitive graph database products, empowering smart enterprises with graph augmented intelligence, and providing our customers with great performance and superior experience.

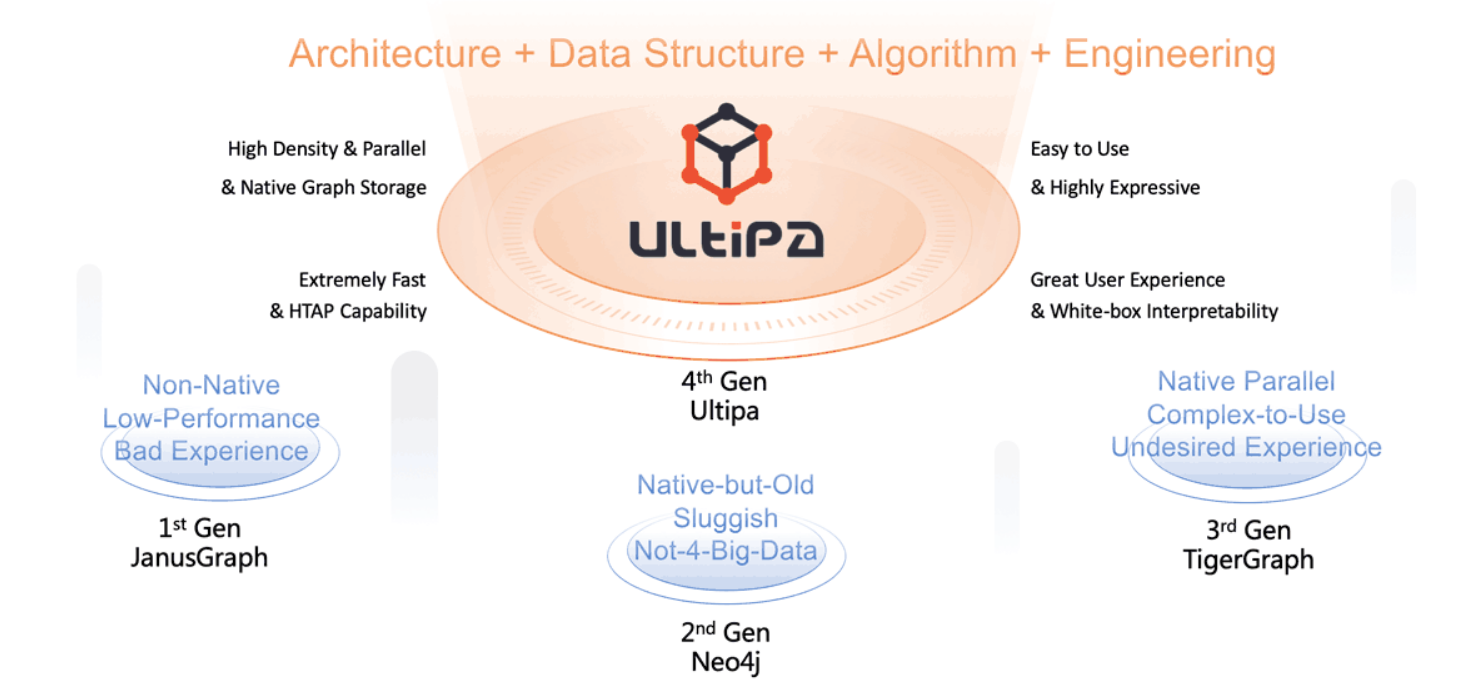

This is an evolution of graph toward OLTP/OLAP calling for a thorough innovation from architecture to data structure, algorithm, and engineering.

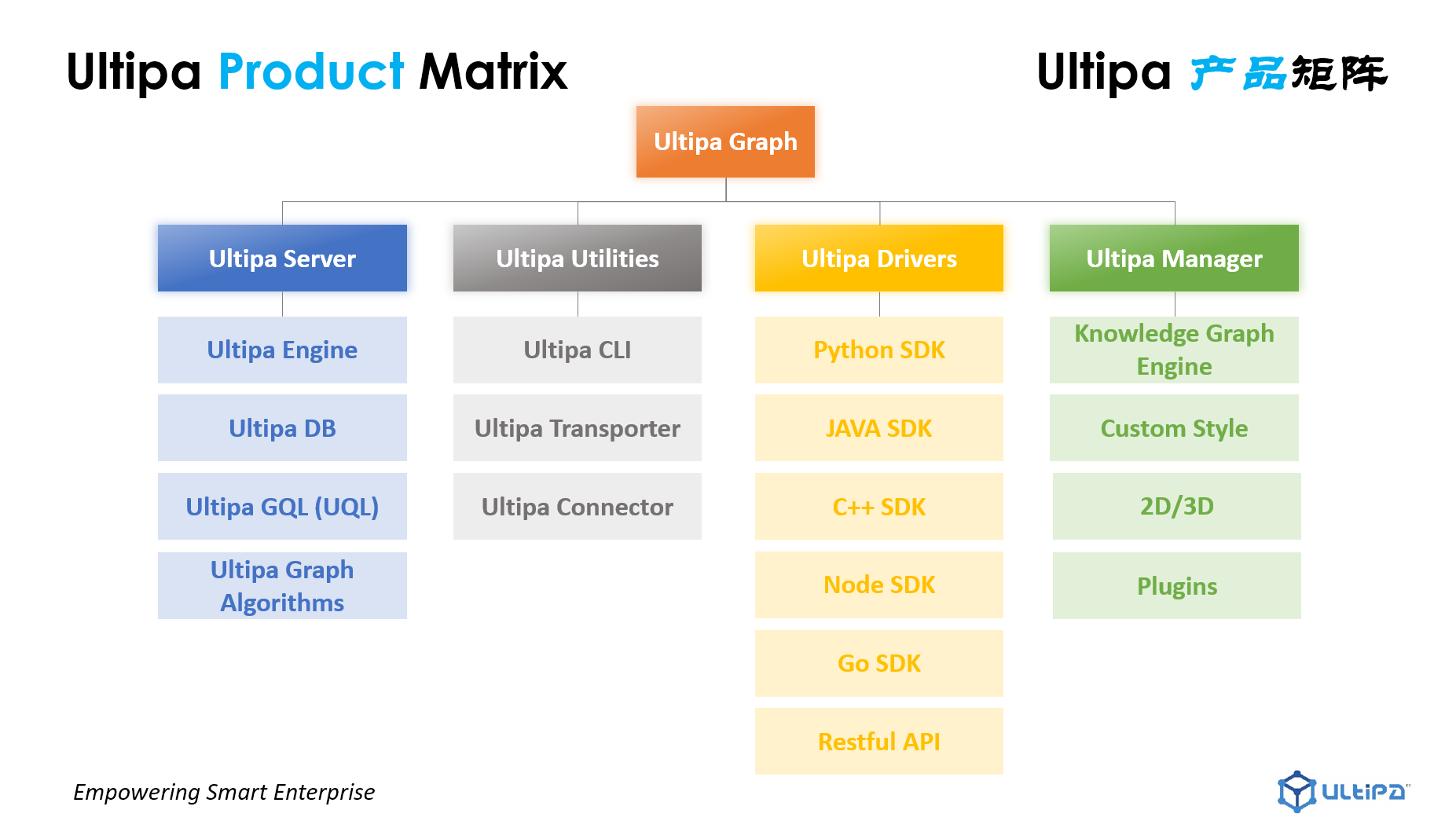

Products Matrix

Ultipa Graph Database

Ultipa KG (Knowledge Graph)

Ultipa UQL (Graph Query Language)

Ultipa Utilities

- Ultipa CLI

- Ultipa Transporter

- Ultipa Drivers (Java | Python | C++ | Golang | Node | Restful API)

- Ultipa Connectors

Ultipa Graph Database Usage Scenarios

- Industrial Internet

- Supply Chain Finance

- Blockchain Database

- Risk Management

- Asset-Liability Management

- Liquidity Management

- Knowledge Graph

- Explainable Al

- Business Research Graph | Real-time Decision Making

- Anti-Fraud | Smart Marketing

- Anti-Money Laundering

- Meta-Data Management

- Multimodal Data Fusion

- Neuromorphic Computing

- Smart Search

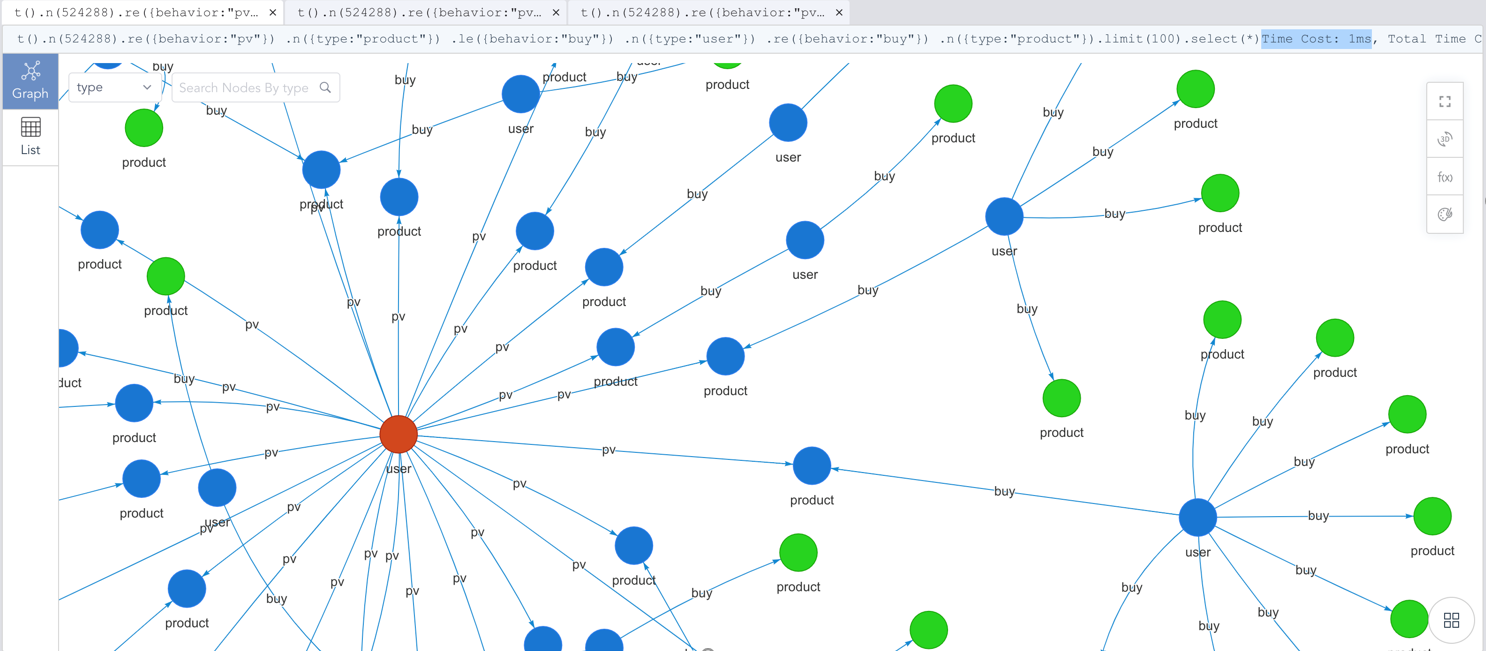

- Recommendation Engine

- Chatbot/NLP

Ultipa Products Success Scenarios

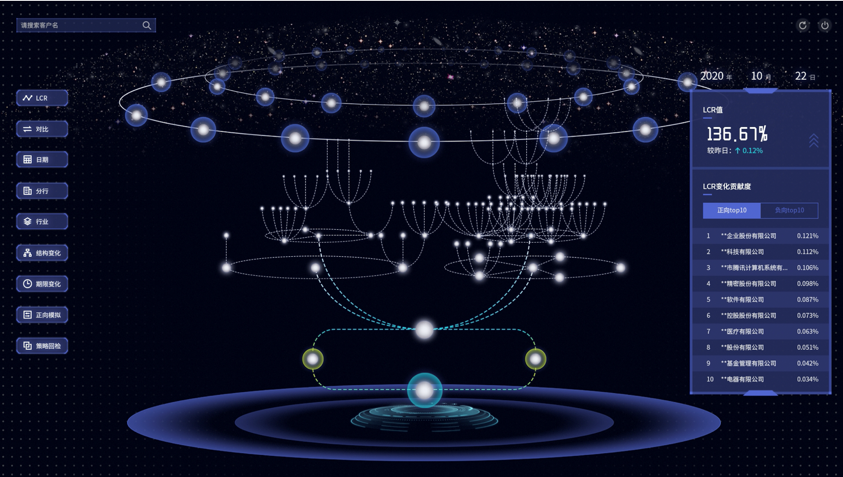

- Liquidity Risk Management System (LCR)

Mastering assets and liabilities meanwhile satisfying domestic and international regulatory needs without hassles. Managing and computing factors like LCR(Liquidity Coverage Ratio) in real-time in a fully explainable white-box fashion.

- Real-time Decision Making (RTD)

Building an online real-time decision-making system with Ultipa Graph Database, dealing with very-high-volume retail transactions with <20mslatency and 10x more full-scale retail data!

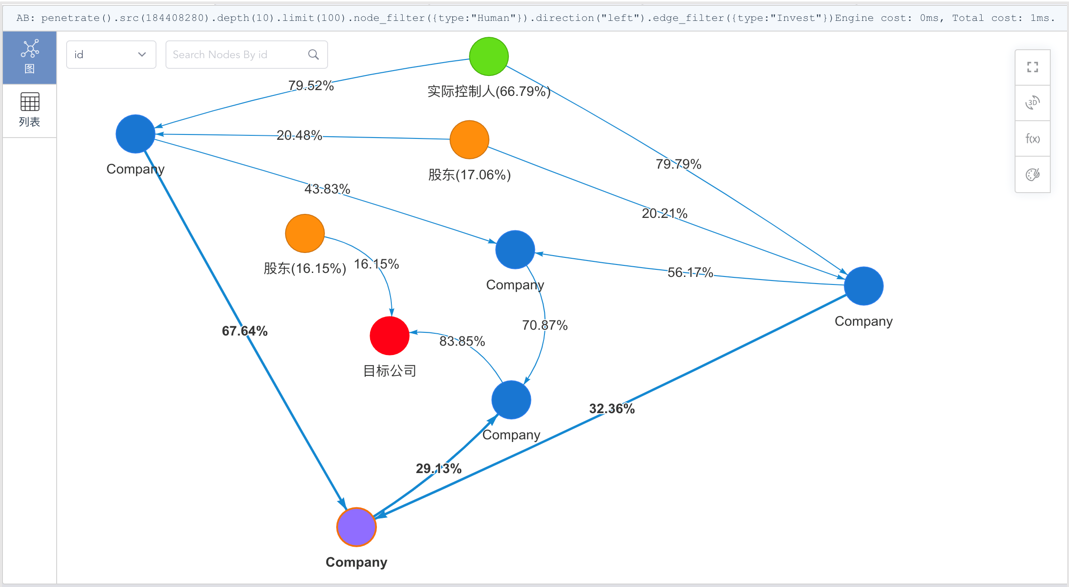

- Smart Graph & UBO

Serving a stock exchange with real-time and super deep penetration for UBO identification, fraud detection, and NLP/chatbots, replacing Neo4j that can't handle billions of data entities in real-time.

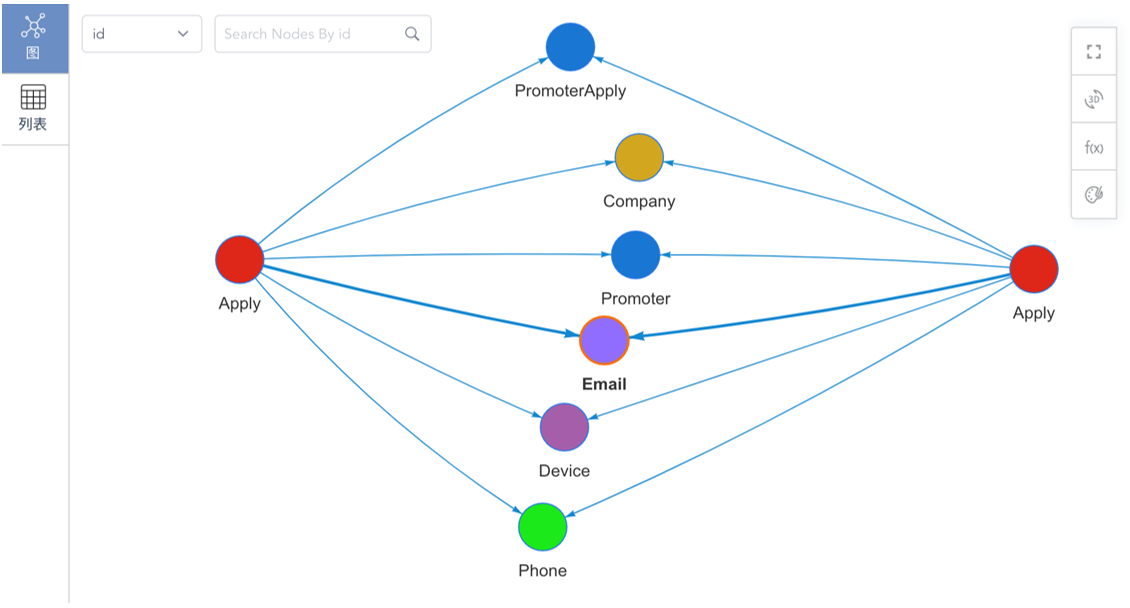

- Online Real-time Anti-fraud

By replacing Apache Spark-based frameworks, eliminating repetitive ETL, gaining a 200-500x performance boost, empowering the customer to realize genuine online and real-time fraud detection!

- Smart Marketing & KYC

Serving a major commercial and retail bank's credit card center for large volumes of data transaction analysis in T+0 fashion for marketing promotion and real-time identification of illegal deal-hunters.

Company Honors

- Best Innovation - 2020 Harvard University NVC

- TMT & AI Runner Up - 2020 Tsinghua University Innovation Competition

- Grand Final Runner Up - 2020 ZGC Bank Fintech International Innovation

Company Patents

- Mass Volume Data Import Method, Device and Storage Medium (2020103125644)

- Graph Data Processing Method, Device, and Storage Medium (2020103313770)

- Graph Database Deep Path Search and Dynamic PruningMethod (2020108170434)

- Graph Database’s Super Node Oriented Data Processing Method, Device and Storage Medium (2020110826742)